Motimahal’s FOCO Hybrid Model

When it comes to restaurant franchising in India, Motimahal has always been a trusted name. With its legacy of authentic North Indian cuisine and a brand presence that goes back decades, Motimahal has consistently evolved with the changing times. One of its most innovative approaches to franchising is the FOCO Hybrid Model (Franchise-Owned, Company-Operated) — a structure that balances ownership and management to create a win-win opportunity for both investors and the company.

In this blog, we’ll explore what makes the FOCO hybrid model unique, why it’s beneficial for investors, and how Motimahal is setting a benchmark in the food and beverage industry.

What is the FOCO Hybrid Model?

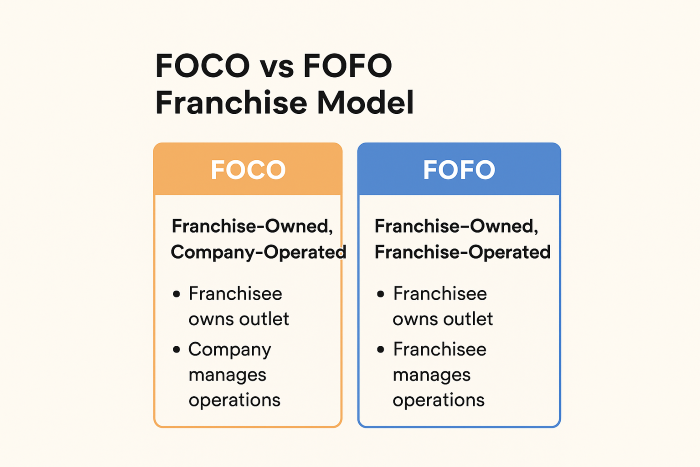

FOCO stands for Franchise-Owned, Company-Operated. It’s a franchise arrangement where:

- The franchisee (investor) owns the outlet, invests in infrastructure, and enjoys ownership benefits.

- The franchisor (Motimahal) takes care of the daily operations — hiring staff, training them, managing supply chains, marketing, and ensuring food quality.

This hybrid model is different from the traditional FOFO (Franchise-Owned, Franchise-Operated) system, where the investor manages everything. With FOCO, the investor becomes a partner in profits without the stress of operations.

Why Investors Love the Motimahal FOCO Hybrid Model

1. Reduced Operational Stress

Running a restaurant is demanding — it requires expertise in kitchen operations, staff handling, vendor management, and marketing. With FOCO, Motimahal shoulders these responsibilities, letting investors focus purely on growth and expansion.

2. Assured Professional Management

Every outlet is operated by the brand itself. That means trained professionals, standardized systems, and smooth management — ensuring that investors don’t have to micromanage.

3. Brand-Driven Consistency

Food businesses thrive on consistency. Motimahal Foco ensures every outlet delivers the same taste, service, and ambiance that the brand is famous for, no matter the location.

4. Lower Risk, Higher Rewards

Operational risks — like staff turnover, poor management, or inconsistent quality — are minimized since the company runs the outlet. Investors can focus on returns instead of firefighting issues.

5. Transparency in Earnings

In FOCO, revenues and expenses are managed by the company with full financial transparency. Investors know exactly how much their outlet is making, reducing chances of mismanagement.

6. Ideal for Non-Industry Investors

Many aspiring entrepreneurs hesitate to enter F&B because of limited experience. FOCO allows them to own a restaurant outlet without needing hospitality expertise.

FOCO vs FOFO: What’s the Difference?

| Feature | FOCO (Franchise-Owned, Company-Operated) | FOFO (Franchise-Owned, Franchise-Operated) |

| Ownership | Franchisee owns outlet | Franchisee owns outlet |

| Operations | Company manages operations | Franchisee manages operations |

| Risk Factor | Lower risk | Higher risk |

| Consistency | Maintained by brand | Varies with management skills |

| Investor Effort | Minimal (company runs business) | High (franchisee must run outlet) |

Motimahal’s choice of the FOCO hybrid system ensures long-term brand quality, while also giving investors peace of mind.

How Motimahal is Setting Industry Standards

Motimahal’s FOCO hybrid model is not just about reducing workload for investors; it’s also about protecting brand legacy. Unlike many franchises that compromise quality while expanding, Motimahal ensures that every outlet reflects the brand’s long-standing reputation.

This hybrid model also encourages investors who may not have a background in hospitality but still wish to be part of the booming food industry. By bridging this gap, Motimahal makes restaurant franchising more accessible, reliable, and rewarding.

FAQs About Motimahal FOCO Hybrid Model

1. Do I need prior restaurant experience to invest in this model?

No. That’s the beauty of FOCO — Moti Mahal Manages the operations at a nominal management fee /royalty.

2. How much capital investment is required?

Investment depends on the location, size of the outlet, and city category. Motimahal provides a detailed cost structure during the franchise discussion.

3. Who handles staffing and training?

The company recruits the staff on behalf of the Franchisee.

4. How do investors earn profits?

As the owner, the franchisee earns revenue from the outlet. The company ensures efficient operations to maximize returns.

5. Can I expand with multiple outlets under FOCO?

Yes, many investors choose to open more outlets once they see success with their first FOCO franchise.

Final Thoughts

The Motimahal FOCO Hybrid Model is a game-changer for aspiring investors. It combines the financial ownership of a franchise with the operational expertise of the company, ensuring growth, profitability, and peace of mind. For those who want to be part of the food industry but don’t want to get tangled in daily operations, this model is truly the best of both worlds.

About Monish Gujral

Monish Lal Gujral is the custodian of the Motimahal global chain of restaurants and the Managing Director of MotiMahal Management Services Pvt. Ltd.

Monish is credited with the trailblazing turn-around of Moti Mahal, from being a small but iconic presence in Delhi, to becoming a multi-national corporation that is well on its way to defining how the world eats Indian food. Mark Manuel (Editor Bombay Times) noted journalist says Mark Manuel Editor Bombay times (2009) Wrote “Monish Gujral is one of modern India’s success stories. In my book he is to Delhi and to rest of India what Rahul Akerkar and Moshe shek are to Bombay : a restaurateur –chef who can cook everything on the menu of his popular chain of Motimahal restaurants , a businessman, a food writer and a gourmet . I know him as a restaurateur and a friend : and , I cannot as yet decide whether I like his food better or his friendship .Probably his friendship, because Motimahal food- its butter chicken, Mata ki daal , roti and kulfi , I can get in 72 cities around India : but not Monish`s genuinely hearty and delightful company .For that , I have to wait till he visits Mumbai